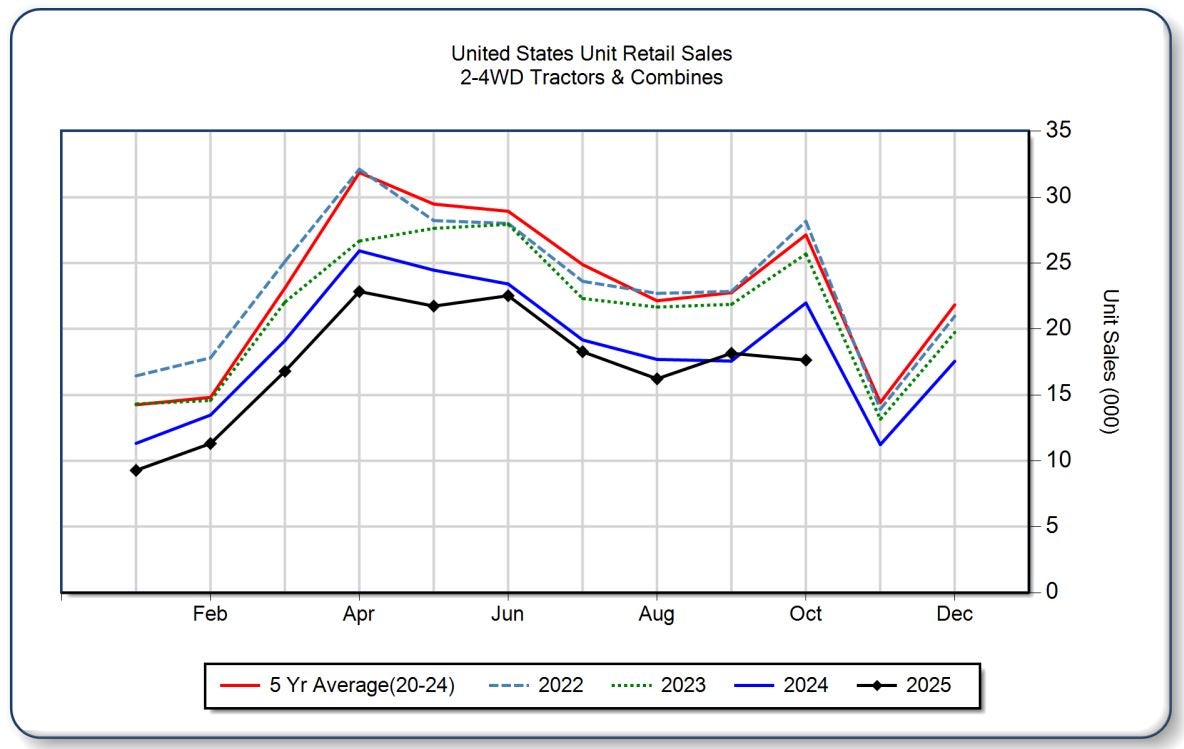

U.S. tractor and combine sales saw a steep year-over-year decline in October, even as farmer confidence edged higher on the strength of the livestock sector, according to the latest report from the Association of Equipment Manufacturers.

The October AEM Ag Tractor and Combine Report showed that total farm tractor sales were down 19.6 percent compared to October 2024, with 17,258 units sold across all drive types. Two-wheel-drive models under 40 horsepower (typically the most active segment) dropped 22 percent, while large tractors over 100 horsepower fell 17.3 percent.

Sales of four-wheel-drive tractors, often used in large-scale crop operations, plunged 56.3 percent from the same month last year. Combine sales were also lower, down 26.8 percent year-over-year.

Through the first 10 months of 2025, total tractor sales were off 9.2 percent, and combine sales trailed 2024 levels by 38.4 percent.

That’s a notable reversal from September’s report, which had shown modest year-over-year gains in some categories, suggesting the October dip reflects renewed caution among producers amid uneven market conditions.

Despite the pullback in machinery sales, the Ag Economy Barometer, a monthly measure of farmer sentiment from Purdue University and the CME Group, rose slightly in October to 129, up three points from September. The increase was fueled mainly by improved profitability in the livestock sector, while crop producers remained more guarded.

The Index of Current Conditions climbed eight points to 130, signaling stronger short-term confidence, but Future Expectations held steady at 129, indicating farmers aren’t yet ready to make major equipment purchases or land investments.

“Producers are feeling a bit better about their current financial position, but lingering concerns about input costs, interest rates, and crop margins continue to hold back spending,” the Purdue report noted.

For many producers, the focus remains on maintaining existing equipment rather than upgrading, especially as new technology and higher prices keep capital costs elevated. Meanwhile, dealers are managing through rising inventory levels, AEM reported nearly 94,000 units in beginning tractor inventory for October, as sales momentum cools heading into winter.