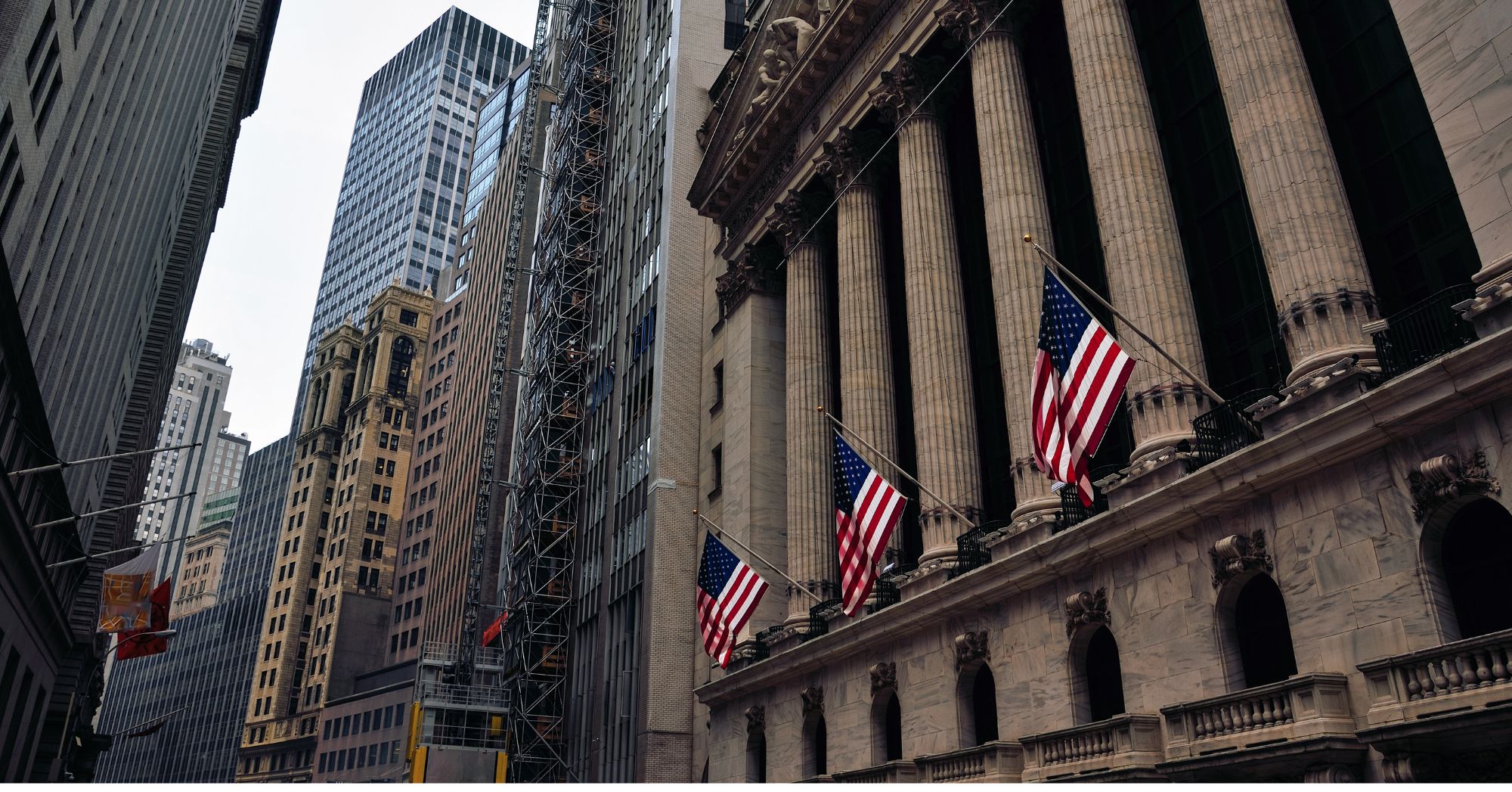

Brazilian meatpacking giant JBS has secured approval from the U.S. Securities and Exchange Commission to list its shares on the New York Stock Exchange, overcoming vocal opposition from environmental advocates and congressional lawmakers who cite the company’s troubled track record on climate, corporate governance, and market competition.

The SEC issued a declaration of effectiveness on Tuesday, clearing the way for JBS — the world’s largest meat producer — to proceed with a shareholder vote scheduled for May 23. The company plans to list through a new parent firm, JBS NV, based in the Netherlands, and also intends to seek a dual listing on Brazil’s São Paulo Stock Exchange.

“We believe this transaction will increase our visibility in global markets, attract new investors, and further strengthen our position as a global food industry leader,” said Gilberto Tomazoni, JBS Global CEO.

But not everyone is celebrating the move. Environmental groups such as Global Witness and Mighty Earth have sharply criticized the SEC for allowing JBS to tap into the U.S. financial market, arguing the company’s listing could further entrench what they consider to be a problematic business model.

Mighty Earth, which submitted five formal challenges to the SEC opposing the listing, said the agency’s approval “shows it is no longer the independent SEC that has upheld honest practices on American markets for nearly a century.” CEO Glenn Hurowitz added, “Given the company’s long rap sheet of illegal and corrupt conduct, it’s hard to see how the SEC could have confidence that JBS won’t deceive US investors.”

JBS has faced mounting scrutiny for its environmental footprint, including alleged ties to illegal deforestation in the Amazon and inconsistent climate claims. The company is currently being sued in the U.S. amid allegations of misleading consumers with its net-zero emissions pledge — claims it has since withdrawn, calling them “aspirational.”

Political concerns have also followed the company’s expansion. A bipartisan group of lawmakers, including former Florida Senator and current Secretary of State Marco Rubio, previously urged the SEC to deny JBS’ listing, warning it could “further entrench its monopoly power” in the meat industry.

Despite the criticism, JBS has argued that a U.S. listing is crucial to unlocking capital and driving growth. The company hopes the move could nearly double its market valuation to around $30 billion, according to estimates from Bloomberg. CFO Guilherme Cavalcanti said the listing “will mark a new chapter in JBS’s history — one with the potential to unlock shareholder value and broaden our investor base.”

Two major JBS shareholders, including one that opposed a similar IPO effort in 2016, have indicated they will abstain from the May vote, removing a significant hurdle for the company’s long-standing listing ambitions. JBS expects shares to begin trading in early June.

:max_bytes(150000):strip_icc()/FullSizeRender-72048b8565f040c094f4dde3fa09e734.jpeg)

:max_bytes(150000):strip_icc()/For-Sale-Farmland-Natalina-Sents-Bausch-d53037fe10b24b288740b5a3089aa5c7.jpg)

:max_bytes(150000):strip_icc()/photos-1245094297-d977d2a6ab834c70b56bf41d4791d016.jpeg)