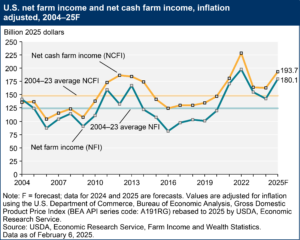

After two years of decline, the U.S. Department of Agriculture projects a strong rebound in farm income for 2025. According to the latest Farm Sector Income Forecast, net farm income is expected to rise to $180.1 billion, an increase of $41 billion (29.5 percent) from 2024.

Similarly, net cash farm income is forecast to reach $193.7 billion, up $34.5 billion (21.7 percent) from the previous year. Even after adjusting for inflation, both figures remain well above historical averages, though still below the record high of 2022.

Despite this projected income boost, total farm cash receipts are expected to decrease slightly, falling $1.8 billion (0.3 percent) to $515 billion in 2025. The decline is primarily driven by lower crop receipts, forecast to drop $5.6 billion (2.3%) due to weaker soybean and corn prices. In contrast, the livestock sector is projected to see a $3.8 billion (1.4 percent) increase, with higher receipts for hogs, milk, and broilers.

A significant factor in the income boost is direct government farm payments, which are set to increase dramatically to $42.4 billion. This spike is largely attributed to supplemental and disaster relief payments under the American Relief Act of 2025.

On the cost side, total production expenses are projected to fall slightly by $2.5 billion (0.6 percent) to $450.4 billion, with the biggest drop expected in feed costs, while livestock and poultry purchases are set to rise.

Farm sector equity is also forecast to increase, with total farm assets reaching $4.40 trillion (a 4.2 percent increase), while farm debt is projected to grow to $561.8 billion (a 3.7 percent increase). The debt-to-asset ratio is expected to remain steady at 12.8 percent, indicating stable financial conditions for the sector.

While the forecast suggests a more profitable year for farmers, challenges remain. Lower cash receipts, particularly for major row crops, highlight the ongoing volatility in commodity markets. Additionally, much of the income growth hinges on government support, raising concerns about long-term sustainability if ad hoc payments decline in future years.

With this rebound in farm income, producers will have opportunities to reinvest in their operations, but continued cost management and strategic planning will be key as the sector navigates shifting market conditions in 2025.

:max_bytes(150000):strip_icc()/39224291520_cc9f911120_o-70e6834782e0498d8c62a80013ac5a95.jpg)

:max_bytes(150000):strip_icc()/2208-05-044_corn-8740989afb284134bb9074978ef9a094.jpg)

:max_bytes(150000):strip_icc()/54429004969_8cc1fa6d4b_o-12893968de0c4ace9aa722b1a74440bc.jpg)