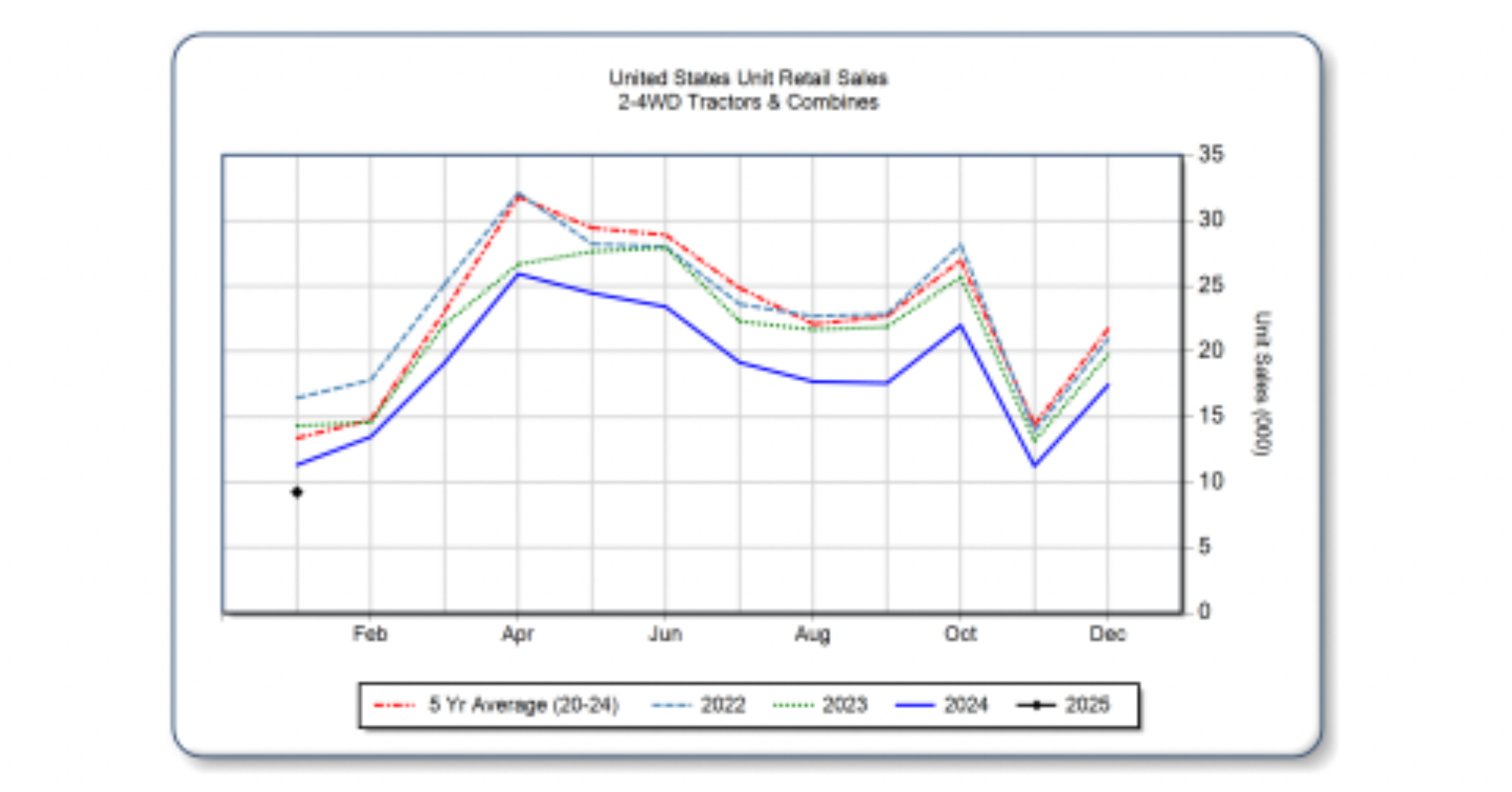

The U.S. agricultural equipment market saw a significant downturn in January 2025, with tractor and combine sales falling sharply compared to the previous year, according to new data from the Association of Equipment Manufacturers . The report highlights a continued trend of declining sales that persisted throughout 2024, reflecting broader economic and policy uncertainties affecting the agricultural sector.

Total U.S. farm tractor sales fell by 15.8 percent year-over-year, with the most substantial decline seen in large tractors. Sales of 2WD tractors with over 100 horsepower dropped by 26.8 percent, while 4WD tractor sales fell by a staggering 54.5 percent. The market for self-propelled combines saw an even more dramatic decline, with sales plummeting 78.9 percent from 460 units sold in January 2024 to just 97 units in January 2025.

AEM Senior Vice President Curt Blades attributes these declines to several ongoing challenges facing the agricultural industry. “As we enter 2025, we’re seeing a continuation of slow sales throughout 2024,” Blades stated. “The ag industry continues to face uncertainties including global trade concerns, tariffs, and the lack of assurance that a farm bill provides. These uncertainties are reflected in the softness of the ag equipment market.”

Canada also experienced a decline in agricultural equipment sales, though the numbers were slightly less severe for tractors. Canadian tractor sales dropped 3.1 percent in January, while combine sales declined by an even steeper 82.9 percent.

This downturn in machinery sales signals potential caution among farmers, many of whom may be delaying major equipment purchases due to economic pressures. With ongoing trade tensions, high input costs, and policy uncertainties, farmers may be prioritizing maintenance and repairs over new investments. Industry analysts will be closely watching the coming months to see if any shifts in economic policy or trade agreements provide relief to the struggling ag equipment market.

»Related: Looking ahead at tractor supply & demand in 2022

:max_bytes(150000):strip_icc()/BloombergContributor-2213407471-950399016ccb4e73ab5886ad1d623b2e.jpg)

:max_bytes(150000):strip_icc()/For-Sale-Farmland-Natalina-Sents-Bausch-d53037fe10b24b288740b5a3089aa5c7.jpg)

:max_bytes(150000):strip_icc()/adm-1-ee7f0c8ca6d74828a32b170d601c90c5.jpg)