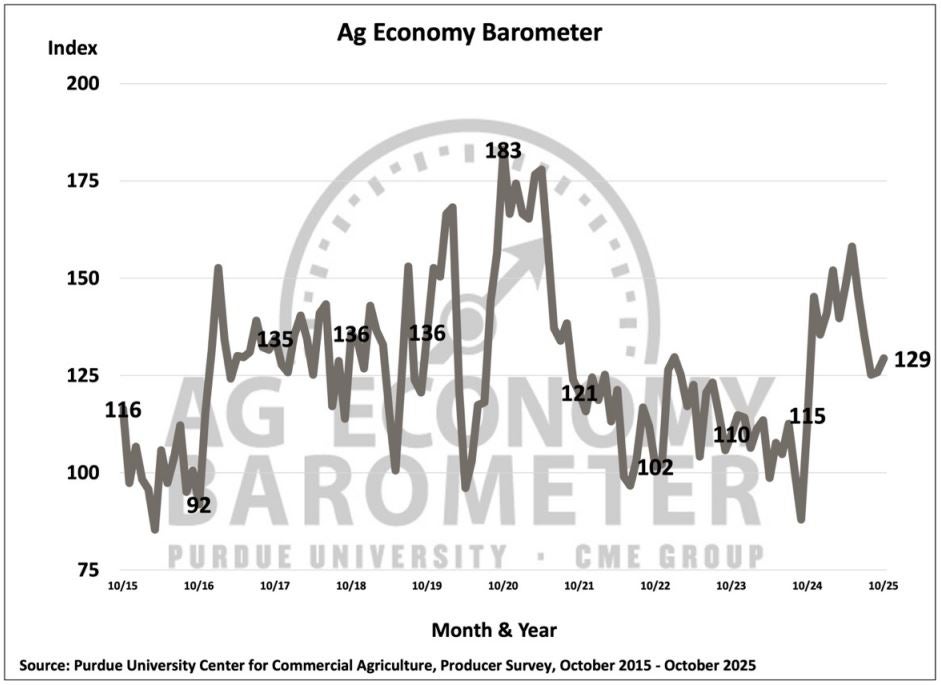

U.S. farmer sentiment edged higher in October, buoyed by strength in the livestock sector, according to the Purdue University-CME Group Ag Economy Barometer. The index rose three points to 129, though it remains 29 points below its May peak. The Index of Current Conditions climbed eight points to 130, while the Index of Future Expectations increased just one point to 129.

“The fact that those two indexes are essentially the same tells me that farmers expect the tight net return scenario we’re in now to persist,” said Dr. Michael Langemeier, professor of agricultural economics at Purdue University. “Livestock producers are facing a much brighter outlook right now, and they expect that to continue.”

James Mintert, director emeritus of the Purdue Center for Commercial Agriculture, added that it’s notable how both indexes are “substantially higher than they were this time last year,” even amid weak crop prices. “It’s a little surprising,” he said. “It does speak to the positive impact of the livestock sector showing up in these results.”

Diverging fortunes in livestock and crops

The Farm Financial Performance Index fell 10 points in October to 78, its lowest reading since May, when it stood at 109. “Forty-nine percent of producers say they’re worse off financially than a year ago,” Mintert noted, “and that really tells the tale.”

That sentiment split sharply along sector lines: 70 percent of livestock producers expect “good times” in the next five years, compared with just 30 percent of crop producers. Langemeier emphasized, “All the indices would be lower if it weren’t for the strong sentiment in the livestock sector.”

Despite declining profitability expectations, the Farm Capital Investment Index rose nine points to 62, as more farmers said it was a “good time to invest.” Langemeier explained, “The Farm Capital Investment Index for livestock was 80 (much higher than for crops) which clearly helped lift the overall number.”

When asked how they would use a potential Market Facilitation Program-style payment from U.S. Department of Agriculture, over half (53 percent) of respondents said they would pay down debt, while 25 percent said they would improve working capital. Only 12 percent said they would use the payment to purchase machinery, and 11 percent would put it toward family living expenses.

“Almost eight out of ten farmers plan to use the funds to strengthen their financial position — and that’s exactly what a good farm management advisor would recommend,” Mintert said.

The Short-Term Farmland Value Expectations Index climbed seven points to 113, breaking a four-month decline. “That was a bit of a surprise,” Langemeier admitted. “Net return prospects for crop producers haven’t improved, so it’s not clear what’s driving the short-term optimism.”

Long-term expectations rose even more sharply. The Long-Term Farmland Value Index jumped fifteen points to 161, matching its high for 2025. “That one makes more sense,” Langemeier added. “People have been flocking to physical assets like gold, silver, and land as an inflation hedge. Historically, farmland has been one of the best long-term hedges against inflation — and unlike gold, it produces a dividend every year.”

Trade expectations, policy confidence

Optimism about agricultural exports also ticked up slightly. Fifty-one percent of farmers expect ag exports to increase over the next five years, up from 47 percent in September. “That’s surprising, given that exports to China have fallen off a cliff,” Mintert said.

When asked about the long-term effects of U.S. tariff policy, 58 percent said it would strengthen the agricultural economy, up from 51 percent last month but below the 70 percent who felt that way in the spring. Meanwhile, sixteen percent said they were uncertain about the impact — double the share who expressed uncertainty earlier this year.

Farmers’ biggest concern continues to be higher input costs (41 percent), followed by lower crop and livestock prices (28 percent). Only about 11 percent cited policy as their top concern — 6 percent farm policy and 5 percent environmental policy.

“They’re focused on fundamentals,” Langemeier said. “Prices are relatively low for crops, high for livestock, and input costs remain elevated. That’s where their attention is.”

When asked if the U.S. is headed in the right direction, 72 percent of producers said yes — a response that has remained remarkably consistent since July. “That’s probably the most stable result we’ve seen in the entire survey,” Mintert said. “Despite all the uncertainty around tariffs and trade, farmers fundamentally think things are going to turn out okay in the long run.”