DAILY Bites

-

Farm income is down, and projected to drop 4.1% in 2024, nearly 23% from 2022.

-

Crop receipts fall 9.2%, with losses in corn, soybeans, and cotton.

-

Livestock receipts up 8.4%, with growth in cattle, milk, and eggs.

DAILY Discussion

The U.S. Department of Agriculture’s December 2024 farm income forecast paints a challenging picture for American agriculture, as farmers face a dramatic decline in net farm income over the past two years.

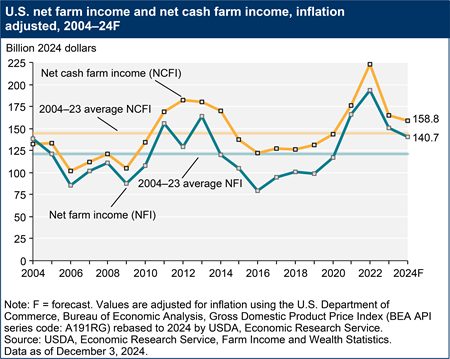

The projected net farm income for 2024 is $140.7 billion, a 4.1 percent decrease from 2023 and 22.6 percent below the peak of $181.9 billion in 2022. Although this marks a slight improvement over earlier forecasts, it offers little relief for producers struggling with shrinking margins.

Crop farmers are bearing the brunt of the downturn, with total crop receipts for 2024 projected to fall by $25 billion (9.2 percent) to $246.2 billion. This decline stems from weaker global demand, falling prices, and increased competition from international markets. Major crops like corn and soybeans are seeing substantial drops in receipts, with corn falling by $16.6 billion (20.8 percent) and soybeans by $6.9 billion (12.3 percent).

Cotton producers are also facing significant losses, with a 26.9 percent decline in receipts. Although certain crops like vegetables and rice show small gains, these are overshadowed by the broader losses.

Livestock producers, however, are faring somewhat better, with receipts for animal and animal products expected to rise by $21 billion (8.4 percent) to $270.6 billion. Cattle and calf receipts are projected to grow by 7.2 percent, and milk receipts by 11.5 percent. The egg sector is particularly strong, with receipts rising by 39.4 percent due to higher prices and demand. However, turkey producers are not experiencing the same gains, with receipts forecasted to decline by 43.3 percent.

Despite lower production expenses, such as declines in feed, fertilizer, and fuel costs, farmers are still grappling with rising costs in labor and interest. Labor expenses are expected to rise by 6.1 percent, and interest expenses by 4.1 percent, continuing to strain farm budgets. Additionally, government payments are forecast to decline by 13.6 percent, primarily due to lower Dairy Margin Coverage payments and a reduction in disaster relief programs, further exacerbating the financial challenges facing farmers.

Farm sector debt is also on the rise, with a projected 4.5 percent increase to $542.5 billion. While farm sector equity is expected to grow due to higher real estate values, the increasing debt and limited liquidity signal ongoing financial strain.

The USDA’s report underscores the volatility of the farm economy, with crop farmers in particular facing significant hardships as they navigate a complex and unpredictable market. As discussions over the farm bill continue, the challenges highlighted in this report emphasize the urgent need for targeted reforms to address the evolving financial landscape of U.S. agriculture.