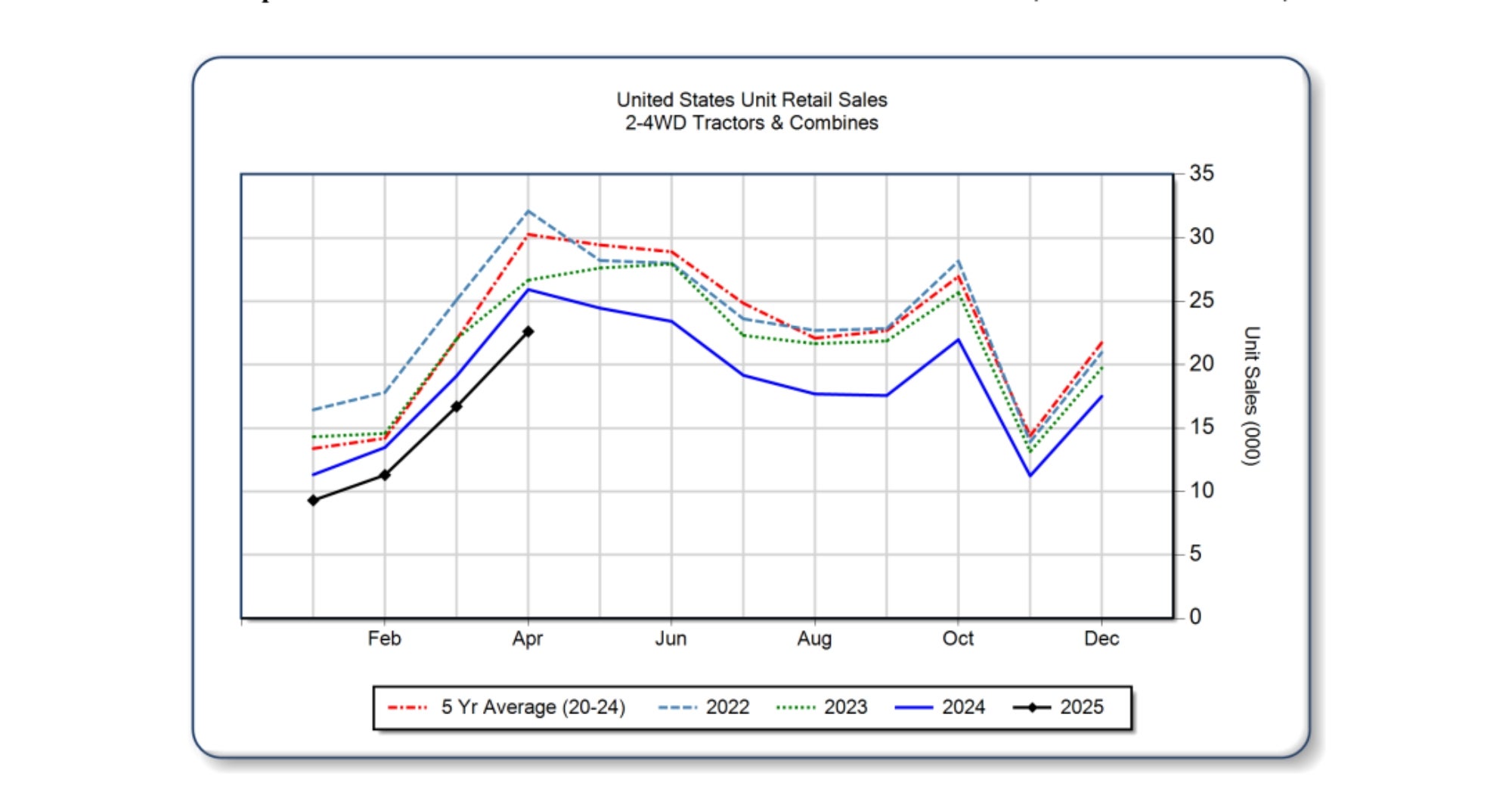

The U.S. agricultural machinery market is staying troubled, as seen from the April 2025 tractors and combine sales, which were released by the Association of Equipment Manufacturers. Both year-to-date and month-by-month sales reports show precipitous declines in nearly all classes of tractors from April 2024.

2WD Farm Tractors experienced an overall decrease of 11.7 percent in April sales and 12.8 percent YTD:

- < 40 HP tractors dropped 10.4 percent in April (15,387 units vs. 17,177 in 2024) and 11.8% YTD (38,244 vs. 43,374).

- 40–100 HP tractors fell 7.3 percent in April and 10 percent YTD, with 14,131 units sold YTD in 2025.

- 100+ HP tractors recorded the highest decline in the 2WD segment, falling 28.5 percent in April and 24.3 percent YTD, with only 5,760 units sold YTD.

Total 2WD tractor sales totaled 21,908 units in April 2025, down from 24,816 a year earlier. Starting inventory for the month was 117,262 units.

4WD tractor information was reported partially, with ongoing weakness in that category. Through April, 4WD tractor sales fell 41.5 percent, although the complete YTD and inventory figures were not reported in the first report.

“The April report of slow tractor and combine sales is reflective of the overall softness in the ag economy. Increased input prices, high interest rates, and global trade concerns are leading to farmers taking more of a cautious approach to their capital investments.” says Curt Blades, Senior Vice President of Association of Equipment Manufacturers. “With planting season underway, we remain optimistic the ag economy will improve, leading to a strengthening of the ag equipment market.”

By April 2025, U.S. ag equipment sales remained down, though some declines eased slightly. Four-wheel-drive tractor sales improved modestly from January’s 54.5 percent drop to 41.5 percent, and two-wheel-drive tractors still posted double-digit losses. The steepest decline continued in the 100-plus horsepower two-wheel-drive segment, reflecting ongoing caution among large-scale farmers. Self-propelled combine sales had previously plunged nearly 79 percent in January.

This moderation in equipment sales may reflect the broader market pressures, including rising input prices, delaying equipment purchase, and commodity price volatility. The downtrend may influence short-term planning by dealers and manufacturers entering mid-2025.

The Ag Tractor and Combine reports can be found on the AEM Market Share Statistics page. The U.S. report can be downloaded from this page, while the Canadian report is available for download here.