In late November, President-elect Donald Trump threatened to impose 25 percent tariffs on imported goods from Canada and Mexico. Despite in-person meetings between Canadian Prime Minister Justin Trudeau and the incoming president, the threats have not subsided, concerning many product and supply-chain industries, including horticulture.

Tariffs on agricultural products are predicted to have two impacts: Canadian producers would face higher production and export costs, while American consumers would experience increased food prices.

Farm and food leaders in both countries are raising alarms because the U.S. is the largest importer of horticultural goods from Canada, as well as from Mexico .

And estimated 53 percent of U.S. fresh fruit imports and 89 percent of fresh vegetable import value come from both trade partners. Canada, specifically, accounts for 20 percent of those fresh vegetable imports and 2 percent of fruit imports, according to the U.S. Department of Agriculture’s Economic Research Service.

Tariffs, however, would muddy the waters for U.S. produce markets heavily reliant on produce imports, as large quantities of tomatoes, peppers, cucumbers, and strawberries — grown in controlled greenhouses — make their way onto American grocery shelves year-round.

Trump has described the move as a “negotiating tactic” for his immigration policy agenda. However, food retailers are taking the threat seriously, with Walmart — America’s largest food retailer — saying, “There probably will be cases where prices will go up for consumers.”

Trudeau also warned that tariffs on Canadian goods would drive up costs for American consumers, saying that the U.S. is “beginning to wake up to the real reality that tariffs on everything from Canada would make life a lot more expensive.”

Trudeau also vowed to retaliate with similar tariffs if Trump follows through with the measures. Ontario’s governor already announced that one potential retaliatory act could be cutting off energy supplies to the Great Lakes.

Danger under glass

The majority of the Canadian greenhouse produce industry is tied to U.S. business. Statistics Canada in 2023 reported 99.5 percent of greenhouse vegetables exported from Canada went to the United States.

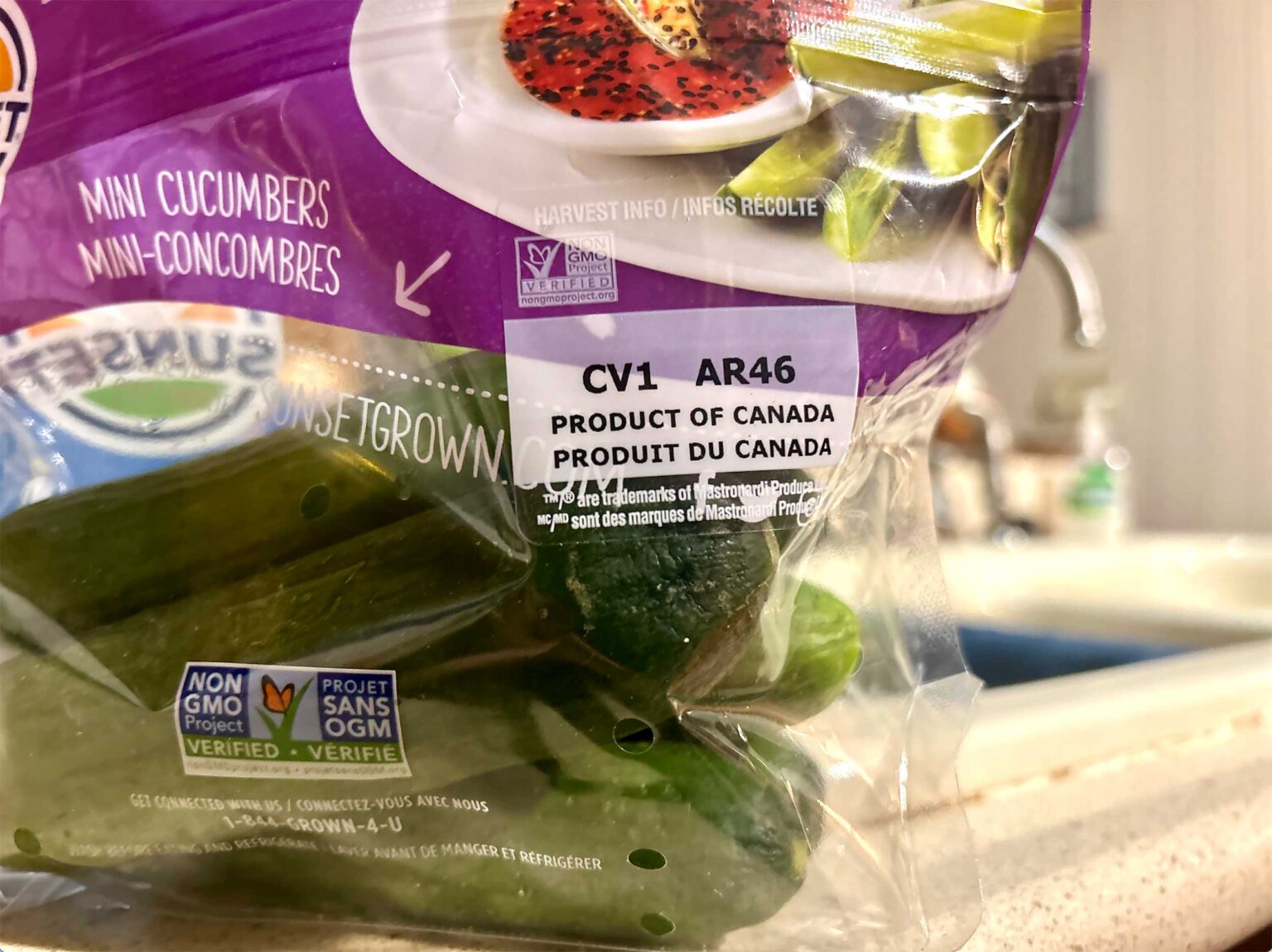

The label, Product of Canada/Produit du Canada, is quite common to see on American shelves. The increase in produce quantity from Canada is attributed to the efficiency of controlled environment greenhouses and hydroponics, which are expanding production by 1 million square meters annually.

Even when hydroponic vegetables are grown in the states and labeled as “Grown in the USA,” the greenhouse industry in North America is predominantly controlled by Canadian companies. Five of the largest greenhouse operations are owned by Canada or their Dutch counterpart: Mastronardi Produce, Windset Farms in California, Village Farms in Texas, Nature Fresh Farms in Ohio, and InterGrow in New York, which is owned by the Dutch.

Field producers still hold most of the produce on the market, but Canadian horticulture might be a difficult fruit to pick in terms of a tariff. Greenhouse produce in Canada makes up a $2.5 billion industry.

In a statement to trade publication Produce Grower, Matt Mika, vice president of advocacy and government affairs for the industry association AmericanHort, said, “AmericanHort is concerned about the impact these potential tariffs may have on the supply chain and the goods used by its members.”

All three of these North American countries — members of USMCA trade agreement — have seasonal patterns of produce trade reliant on one another.

For example, the tomato trade is highly seasonal. Mexico is the largest exporter of fresh tomatoes to the U.S., especially in winter when U.S. field production drops, while Canada exports greenhouse tomatoes to the U.S. during the off-season. Greenhouse tomatoes from Mexico and Canada are essential for year-round demand, with the U.S. heavily relying on these imports. Canadian greenhouse tomatoes are almost exclusively exported to the U.S., with no shipments to Mexico.

Canada does benefit from fruit and vegetable imports, 84.9 percent of which are sourced from Mexico but only at a quarter of the rate in which the country exports the same goods.

The ripple effects of tariffs are anticipated to extend to Europe, the U.S.’s second-largest import market. And beyond that, Europe’s stake includes the fact that 90 percent of all greenhouses globally are of Dutch origin. Technology, construction, lighting, irrigation and grower managers from the Netherlands are virtually in every controlled environment greenhouse in North America. Local workforces in the U.S., Canada and Mexico have yet to match these specialized skills of the Dutch.

Many Canadian greenhouse growers also have Dutch heritage and rely on financing and business partnerships in the Netherlands, despite being based in North America.

Future negotiations

The threat of tariffs could be a way of attaining leverage over Mexico and Canada in the lead-up to renegotiating the USMCA trade deal, set for review in 2026.

Keith Currie, President of the Canadian Federation of Agriculture, countered this notion, stating in an interview, “We are their biggest trading partner, not just us being theirs.”

At the Ontario Federation of Agriculture annual meeting in early December, members introduced preemptive measures prior to any formal tariff action. The motions request the Canadian government to negotiate exemptions of agriculture products from U.S. tariffs, provide producers a list of U.S. products that would be subject to retaliatory tariffs from Canada, and for Canada to push U.S. allies to respect of the USMCA agreement rules . These tariff action measures will be considered by the national board of CFA by the end of the year.

Ontario, known as the horticulture providence of Canada, holds 72 percent of Canada’s greenhouse production.

“This is a review. The agreement is in place until 2040. Keep it that way. Don’t renegotiate,” Currie said, referring to Trump gaining leverage in USMCA discussions.

Jake Zajkowski is a freelance agriculture journalist covering farm policy, global food systems and the rural Midwest. Raised on vegetable farms in northern Ohio, he now studies at Cornell University.

:max_bytes(150000):strip_icc()/ChelseaSoybean-1-bf9ee026d8404010b490965515e33078.jpg)