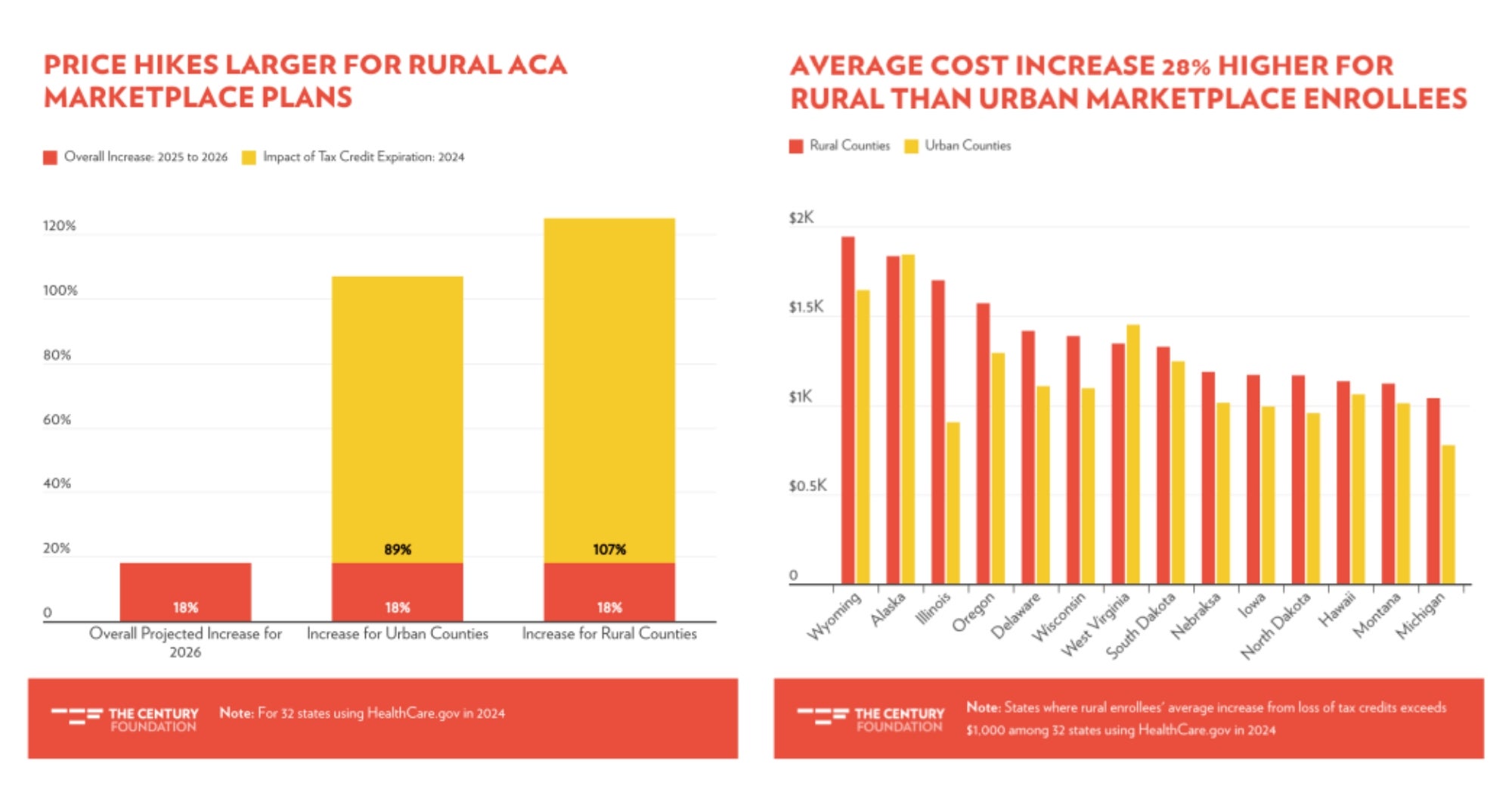

Health insurance marketplace enrollees are set to experience the steepest median premium increases in five years, with individual market plans facing an average proposed increase of 18 percent as of August 6, 2025, according to some of the newest data available. Simultaneously, scheduled reductions in premium tax credits beginning January 2026 will send out-of-pocket costs soaring an average of 93 percent across states using HealthCare.gov.

The new analysis from The Century Foundation warns that rural Americans are on the brink of devastating increases in health care costs as insurance premiums rise and federal tax credits shrink.

This combination of higher premiums and lower subsidies will hit rural Americans hardest, creating what analysts describe as a “double whammy” of financial pressure on communities that already struggle with limited access to affordable care.

The analysis of 32 HealthCare.gov states highlights a stark divide between rural and urban residents:

- Rural residents face a 107 percent increase in out-of-pocket premiums, compared to 89 percent in urban counties, on top of the national 18 percent median increase.

- On average, rural Americans’ health care cost increases will be 28 percent higher than those in urban areas.

- In 14 of the 32 states, rural residents will lose over $1,000 annually in tax credits.

These numbers are not just abstract percentages. They translate into devastating real-life consequences for millions: 2.8 million rural Americans currently rely on marketplace coverage, including 776,000 adults ages 55 to 64 and over 223,000 children.

Maps and charts from the report show that residents in the Upper Midwest and Southeast are at greatest risk, both because of steeper premium increases and heavier reliance on marketplace plans. In states like Alabama, Mississippi, Nebraska, North Carolina, South Carolina, Texas, and Wyoming, more than one in ten non-elderly rural residents are enrolled in marketplace plans.

For many families in these regions, the impending policy changes could mean the difference between maintaining health insurance and going without coverage altogether.

As health care costs rise across the board, the burden will fall hardest on communities already facing shortages of providers, longer travel distances for care, and higher rates of chronic illness.