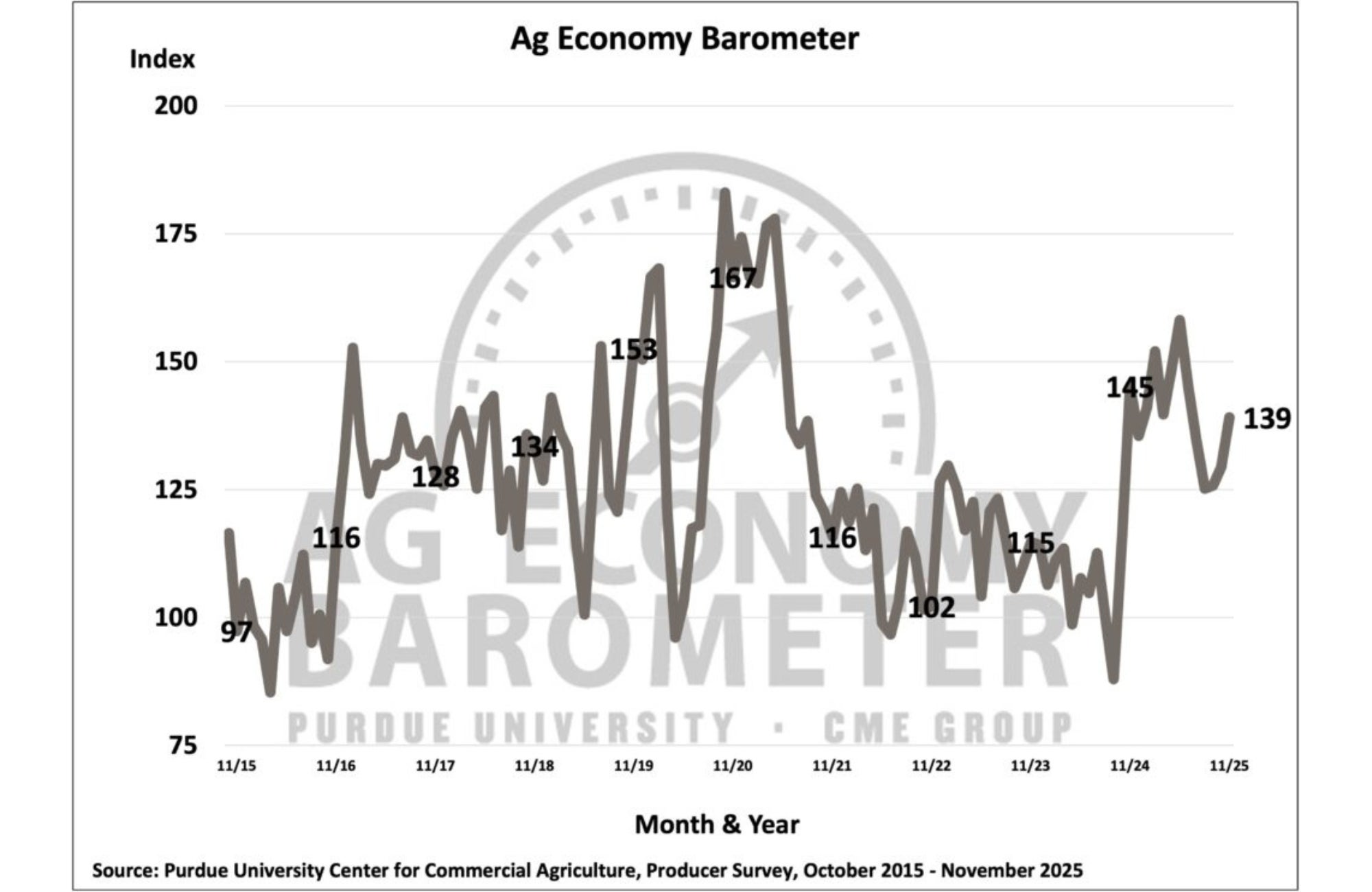

U.S. farmer sentiment strengthened in November, and the improvement looks notably different from October’s story.

The Purdue University-CME Group Ag Economy Barometer climbed to 139 in November, up 10 points from October and the highest reading since June. While October’s modest gain was driven largely by better “current conditions,” November’s jump was powered by a much more optimistic view of what’s ahead. The Future Expectations Index rose 15 points to 144, while the Current Conditions Index slipped 2 points to 128.

That’s a key contrast with October, when the barometer rose three points to 129, and the Current Conditions Index climbed 8 points to 130, but Future Expectations barely moved (up one point to 129). In short, October felt like “things are better right now,” while November reads more like “the outlook is improving.”

The November survey (conducted November 10 to 14, 2025) was the first conducted after a late-October announcement of a U.S.-China trade pact that included provisions to increase U.S. agricultural exports to China, and respondents were notably more upbeat about future export prospects. Sentiment was also supported by a sharp rise in crop prices from mid-October to mid-November.

Crop prices lift the outlook as livestock turns into a headwind

Producers in November reported a stronger financial outlook for their farm operations. The Farm Financial Performance Index climbed 14 points to 92, and the share of producers who expect better financial performance this year rose to 24 percent, up from 16 percent in October.

A surge in crop prices was a major driver. For example, Eastern Corn Belt prices for fall delivery rose about 10 percent for corn and 15 percent for soybeans from mid-October to mid-November. That crop-side strength outweighed a weaker outlook from livestock producers, who were feeling pressure from a decline in cattle prices during the same period.

This also marks a shift from last month’s narrative, when livestock gains featured prominently in explaining firmer confidence. In November, crops and trade optimism did more of the heavy lifting.

Despite improved financial expectations, producers were more cautious on big purchases. The Farm Capital Investment Index fell 6 points to 56, with just 16 percent of respondents saying it’s a good time to make large investments in their farm operation.

That’s another notable contrast with October, when the Farm Capital Investment Index rose to 62, aided in part by improved sentiment among livestock producers. November flips that script: better overall confidence, but less appetite for spending.

Trade expectations strengthen

Producers became more optimistic about agricultural exports over the next five years. Just 7 percent of respondents said they expect U.S. agricultural exports to weaken over the next five years, down from 14 percent in October and down from 30 percent in March. In a related question, 47 percent of corn producers said they expect soybean exports to rise over the next five years, while 8 percent expect soybean exports to decline.

Most producers still expect a supplemental U.S. Department of Agriculture support payment similar to the 2019 Market Facilitation Program, but they’re less confident than earlier in the fall. In November, 16 percent said an MFP-style payment is “very likely,” down from 62 percent in September. Combining “likely” and “very likely,” 76 percent expect an MFP-style payment, compared with 83 percent in September. If received, 58 percent said they would use it to pay down debt, up from 52 percent in October.

Farmland values stay firm and long-term optimism hits a record

For the second month in a row, producers’ expectations for farmland values improved. The Short-Term Farmland Value Expectations Index rose to 116, up 3 points from October and 10 points above September. The Long-Term Farmland Value Expectations Index increased 4 points to 165, setting a new record high. Asked about 2026 cash rental rates, 74 percent of corn producers said they expect rates to be about the same as this year, consistent with responses seen in July and August.

A majority of respondents (59 percent in November and 58 percent in October) said they expect U.S. use of tariffs will ultimately strengthen the agricultural economy, though that’s down from last spring when 70 percent said tariffs would be beneficial in the long run. Uncertainty has also increased: 17 percent of respondents in November said they’re uncertain about the long-run impact of tariff policy, roughly double the 8 percent who said they were uncertain in April and May.

Meanwhile, 67 percent said the U.S. is headed in the “right direction,” down from 72 percent in October, while the share saying “wrong track” rose from 28 percent to 33 percent.

Farmer sentiment improved sharply in November, driven by an upswing in future expectations tied to stronger crop prices and a more optimistic trade outlook. Compared with October, when better current conditions and livestock strength played a larger role, November’s story tilts more toward forward-looking optimism, even as producers grow more cautious on large investments and slightly less confident about the country’s direction.