DAILY Bites

-

Farmer sentiment surged in November, with both sub-indices seeing significant increases, with optimism fueled by expectations of a favorable regulatory and tax environment following the U.S. presidential election.

-

33% of farmers expect better financial performance for their farms in the next year, up from 19% in October.

-

While 55% of respondents predict less restrictive environmental regulations under the new administration, 42% fear a potential trade war could harm U.S. agricultural exports, underscoring the balance of optimism with caution.

DAILY Discussion

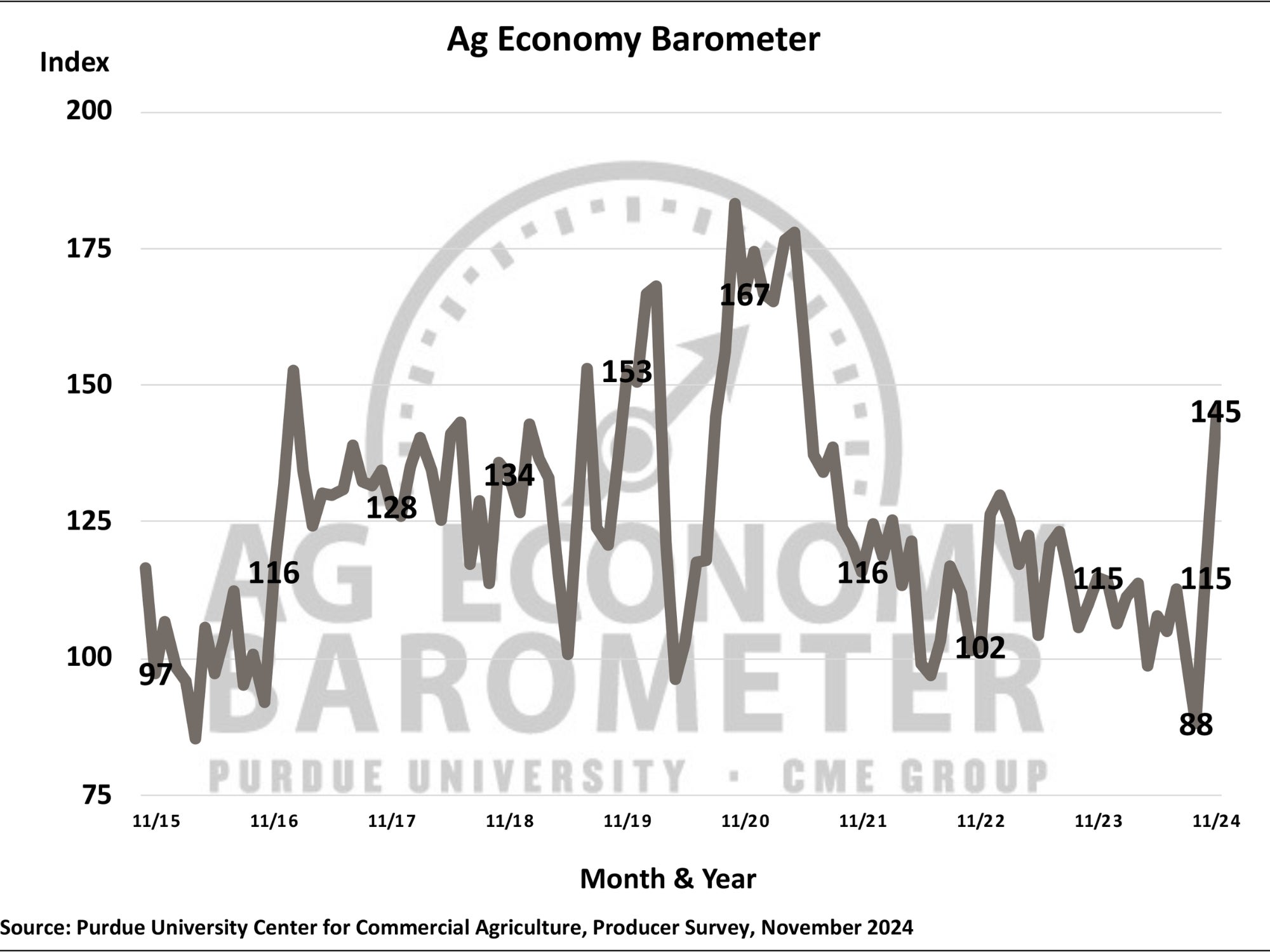

Farmer sentiment jumped again in November, with the Purdue University/CME Group Ag Economy Barometer climbing 30 points to a reading of 145. This marked the highest level of farmer optimism since May 2021.

Both of the barometer’s sub-indices increased in November. The Future Expectations Index saw the largest jump, rising 37 points to 161, while the Current Conditions Index increased 18 points to 113. The November sentiment boost reflects growing optimism about a more favorable regulatory and tax environment for agriculture following the U.S. election. This month’s survey was conducted from Nov. 11 to 15, 2024, the week following the U.S. presidential election.

In November’s survey, farmers reported a notably more positive outlook for their operations and the broader agricultural economy than in prior months. The percentage of producers expecting their farm’s financial performance to improve over the next year climbed to 33 percent, up from 19 percent in October. Optimism about the U.S. agricultural sector also surged, with 34 percent of farmers anticipating good times financially in the next 12 months, more than double October’s 15 percent.

Looking ahead five years, over half of November’s respondents (52 percent) predicted widespread prosperity for U.S. agriculture, a noticeable increase from 34 percent the previous month. This growing confidence was also reflected in farmers’ investment plans, as 22 percent reported that it’s a good time for large capital investments, compared to 15 percent in October.

Farmers’ improved sentiment also carried over to their investment outlook, as the Farm Capital Investment Index rose 13 points in November to a reading of 55 — the highest level since May 2021. The change in investment sentiment was partly driven by expectations of stronger financial performance in 2025 compared to 2024.

For the second consecutive month, the percentage of producers expecting better financial conditions in the year ahead increased, climbing to 25 percent in November, up from 16 percent in October. This shift drove the Farm Financial Performance Index up to 106, marking a 16-point increase from October and a substantial 38-point jump since September.

Following the improvements in the short-term and long-term farmland value indices in October’s survey, both indices saw modest declines in November. The Short-Term Farmland Value Expectations Index dropped by 5 points, while the Long-Term Farmland Value Expectations Index decreased by 3 points. Despite these small decreases, the indices remained relatively strong, with the short-term index at 115 and the long-term index at 156.

To gain insight into how farmers’ sentiment might align with potential policy shifts following a change in presidential administrations, barometer surveys included several policy-related questions before and after the 2020 and 2024 elections. In the wake of the 2024 election, farmers’ views on environmental regulations experienced a sharp reversal.

In October, 41 percent of respondents anticipated a more restrictive regulatory environment over the next five years, while only 10 percent expected less restrictive regulations. However, the November survey saw a dramatic shift, with just 9 percent of surveyed farmers expecting stricter regulations and 55 percent predicting a more favorable, less restrictive regulatory landscape.

There was a modest shift from October to November 2024 when asked about tax expectations, but there was a notable contrast with responses received following the 2020 election. In November 2024, more than half (55 percent) of respondents expected income tax rates to remain unchanged, compared to just 25 percent in 2020. Similarly, 57 perent of respondents in the November survey anticipated estate tax rates staying the same over the next five years, a large increase from 28 percent in November 2020.

While optimism is up, farmers are also expressing concerns about the potential risks to agricultural trade, with many fearing that a trade war could significantly impact U.S. exports. Forty-two percent of November’s survey respondents indicated they believe it is “likely” or “very likely” that U.S. agriculture could face a “trade war,” potentially leading to a significant decline in agricultural exports.

Recent barometer surveys reveal that, looking ahead 2025, farmers’ outlook for agriculture remains positive. However, U.S. producers are closely monitoring the evolving political landscape and its potential impact on policies affecting their farms and international trade.