U.S. farm profits are projected to climb in 2025, marking a sharp rebound from recent years of financial pressure, according to new forecasts released by the U.S. Department of Agriculture’s Economic Research Service.

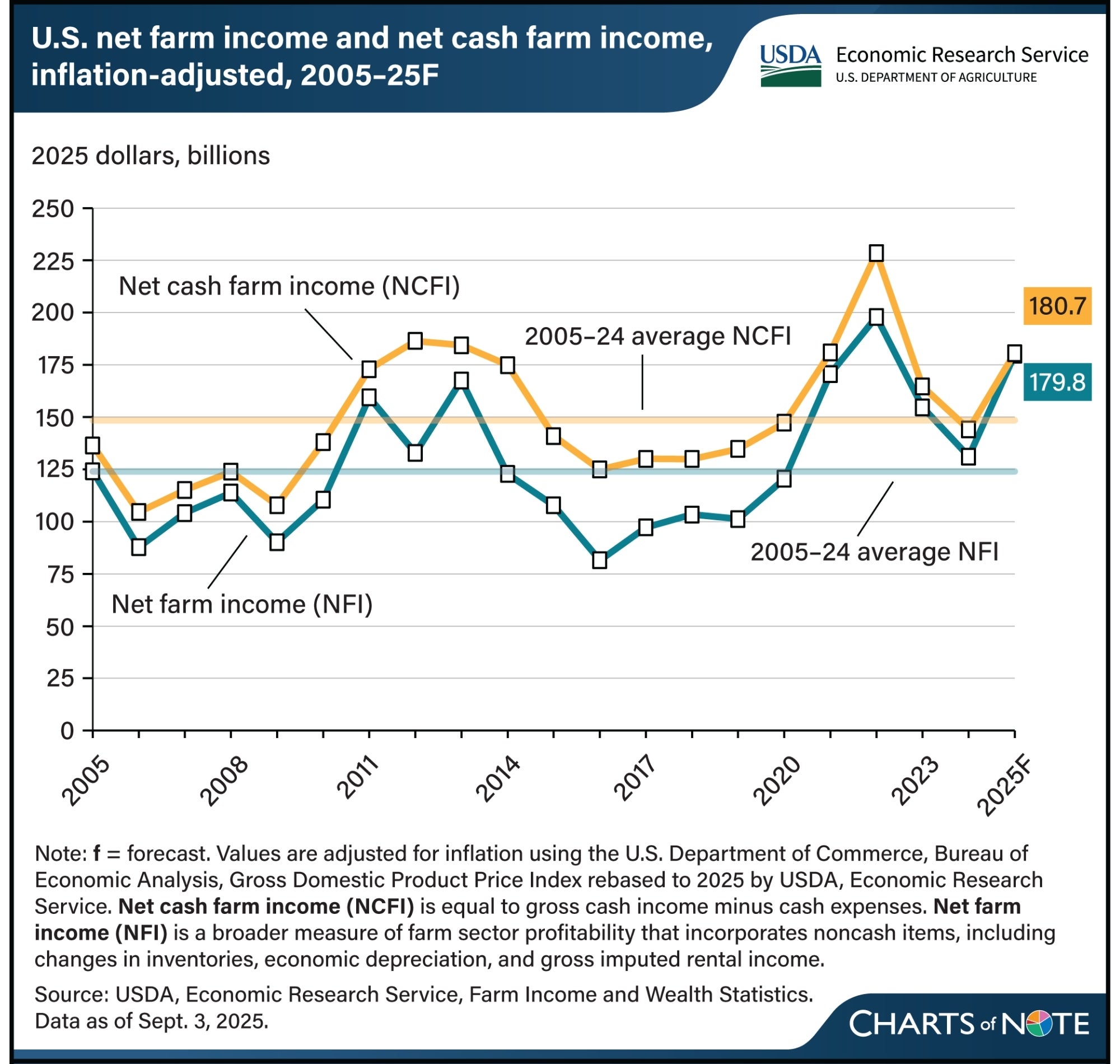

ERS economists now project net cash farm income to rise by $36.5 billion, or 25.3 percent, reaching $180.7 billion in 2025. Net farm income, a broader measure of sector profitability, is expected to increase by $48.8 billion, or 37.2 percent, to $179.8 billion. Both measures would surpass their 20-year averages but remain below the all-time highs recorded in 2022.

A major driver of this rebound is a surge in direct government payments. The ERS projects these payments will jump from $10.4 billion in 2024 to $40.5 billion in 2025, largely due to supplemental and ad hoc disaster assistance provided under the American Relief Act of 2025.

The forecast also shows a divide between crop and livestock producers, echoing recent findings from Purdue University’s Ag Economy Barometer. While animal and animal product cash receipts are forecast to grow by $23.2 billion (an 8.4 percent increase), crop cash receipts are projected to fall $12.3 billion (a 4.9 percent decline).

Weaker returns for corn and soybeans are weighing on crop producers, with the USDA estimating season-average corn prices at $3.90 per bushel and soybeans at $10.10 per bushel, levels that many analysts say fall below breakeven for farmers. Meanwhile, strong demand and tight supplies continue to bolster livestock markets, particularly beef cattle, which are seeing record profitability.

The September numbers build on the USDA’s February 2025 forecast, which also predicted a rebound after two years of decline. At that time, analysts projected net farm income would rise nearly $41 billion. Today’s update not only confirms those expectations but points to an even stronger jump in profitability, underscoring the heavy role of federal support programs in stabilizing the sector.

Still, farmer sentiment has not mirrored the optimistic forecasts. As the Ag Economy Barometer reported earlier this week suggests, producer confidence fell for the third straight month in August, reflecting financial stress, especially among crop producers carrying over unpaid debt into 2026.

While the 2025 outlook is positive on paper, concerns remain over long-term stability. Much of the projected profit growth hinges on temporary government aid, not market fundamentals. Without such support, income could once again face downward pressure in future years.

The ERS cautions that results may shift if crop conditions, global demand, or federal policy change significantly in the months ahead. For now, the sector is poised for a stronger year, giving producers